Map Your Taxes Missouri – More From Newsweek Vault: Rates Are Still High for These High-Yield Savings Accounts Explore the interactive map below to see what your state’s tax burden is. For instance, New York and . Your net income, salary minus the taxes owed, is $73,077. For Missouri, the total tax rate with federal, FIX and state income taxes considered on a $100,000 salary is around 27%. The calculations .

Map Your Taxes Missouri

Source : showmeinstitute.org

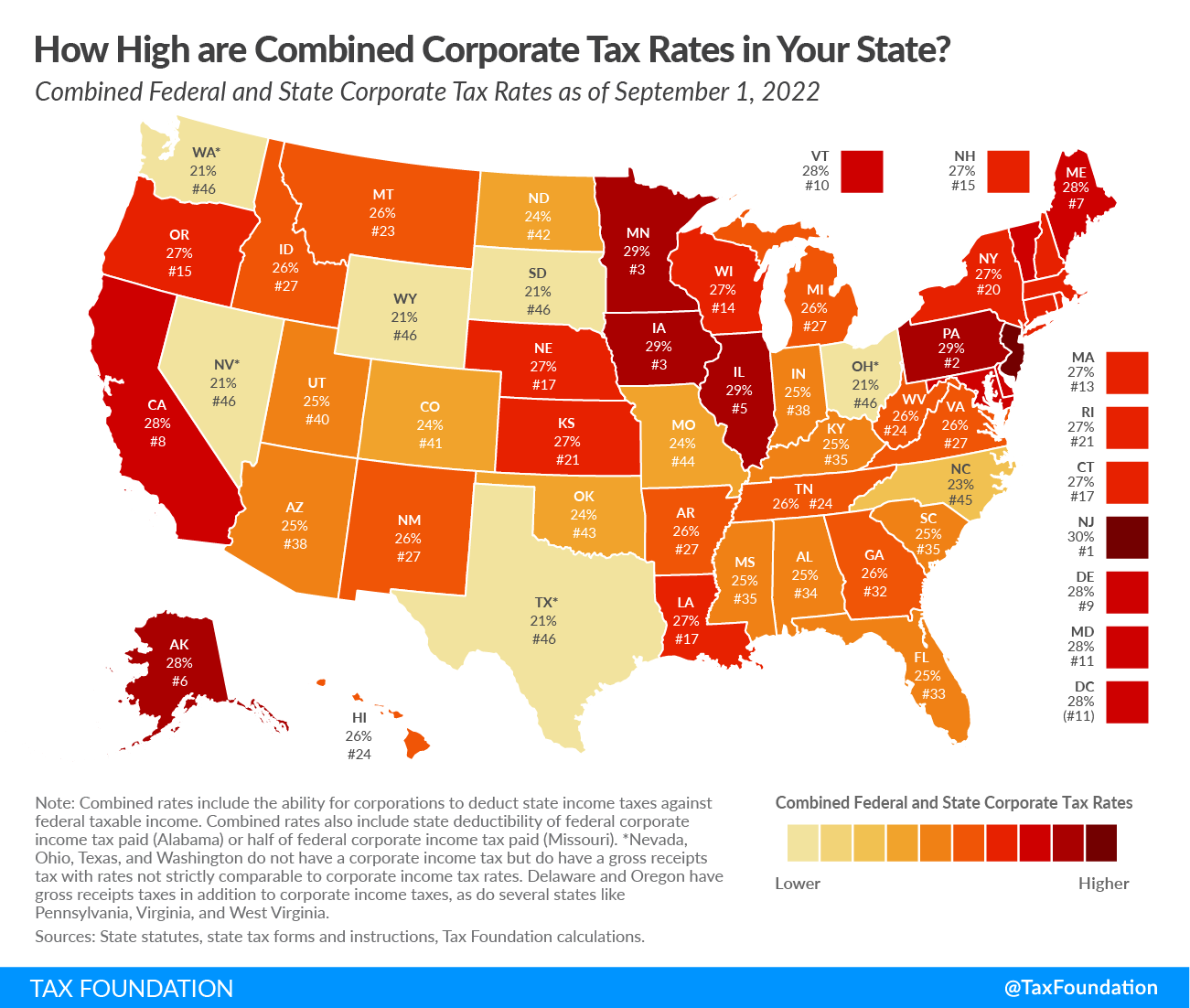

Combined State and Federal Corporate Tax Rates in 2022

Source : taxfoundation.org

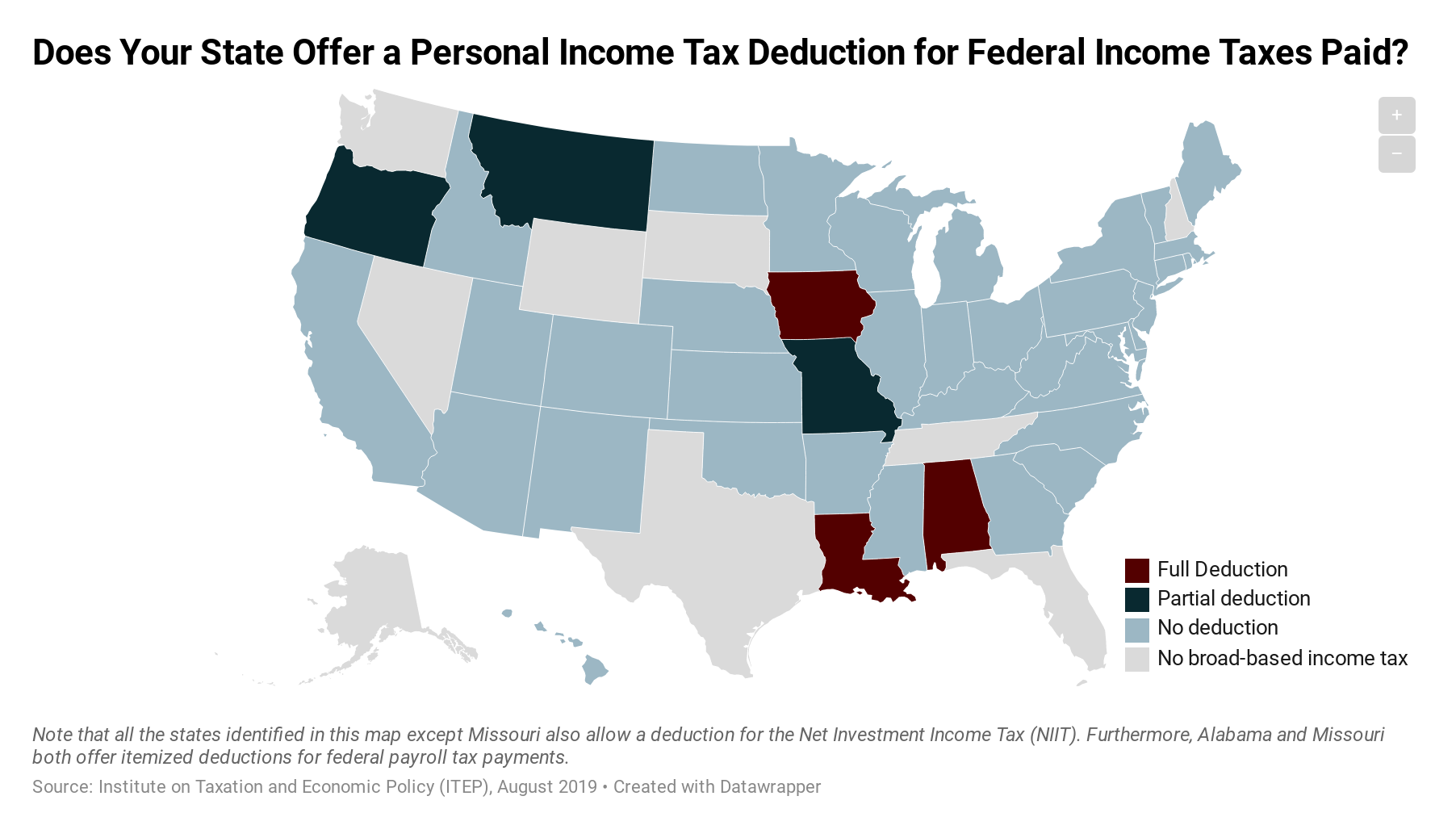

Which States Allow Deductions for Federal Income Taxes Paid? – ITEP

Source : itep.org

2024 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.org

The Evaluator: Deadlines Looming in 7 States Summer 2021

Source : www.vorys.com

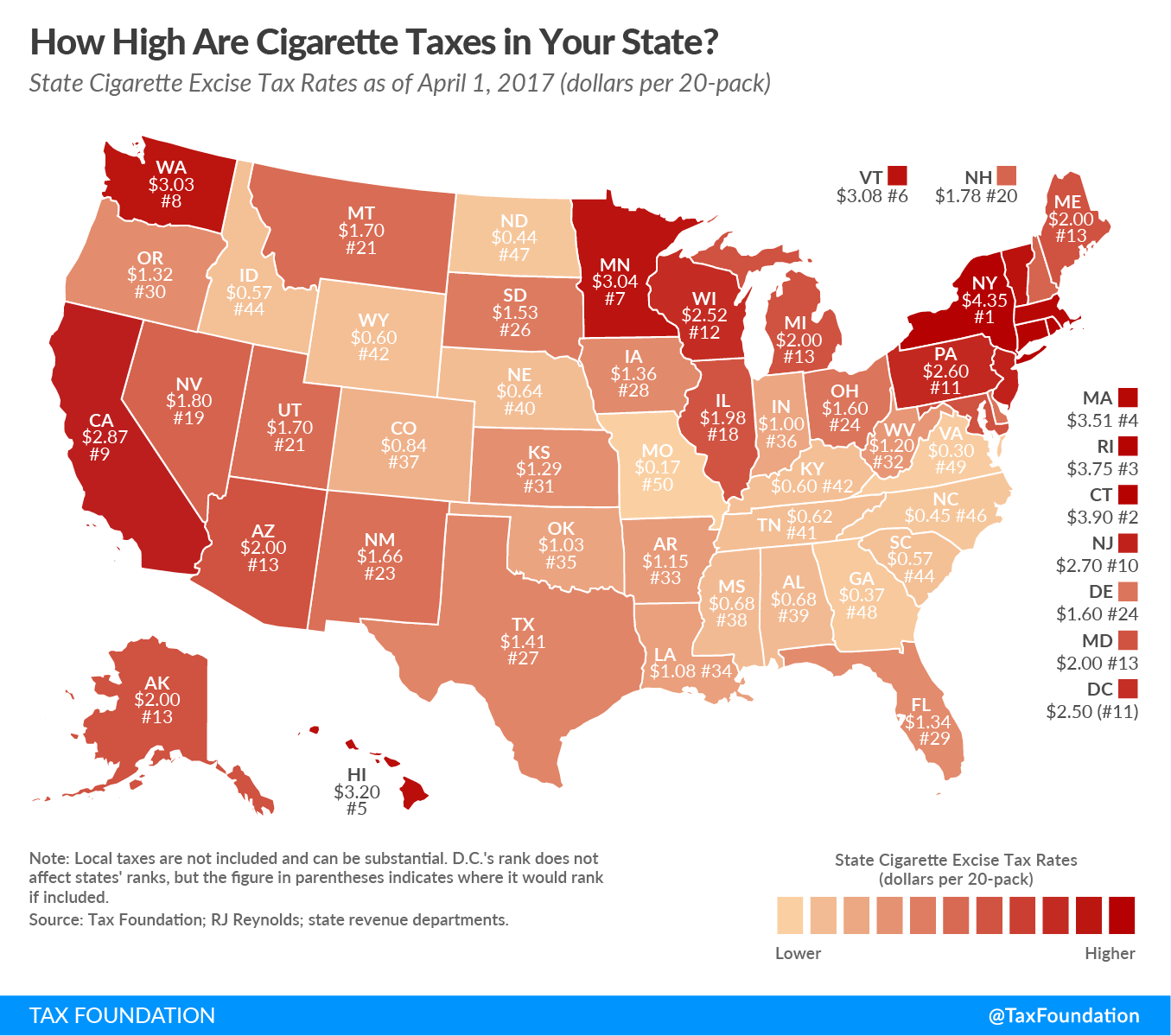

How High Are Cigarette Taxes in Your State?

Source : taxfoundation.org

Missouri Tax Sales Title litigation, redemption notices, tax

Source : missouritaxsales.com

Where Your Taxes Go | Cole County, MO

Source : colecounty.org

When Did Your State Enact Its Gas Tax?

Source : taxfoundation.org

Inflation Reduction Act Energy Cost Savings | Congressman Emanuel

Source : cleaver.house.gov

Map Your Taxes Missouri Map of Commercial Property Tax Surcharges in Missouri Show Me : Recent updates to Missouri’s property tax freeze program for seniors have made many more homeowners eligible for the program. But state laws and county-level policies mean that even if you are . A Missouri State Highway Patrol trooper charged with felonies is set to appear before a judge in Scott County on Tuesday. .